Blog

Express Scripts

Teladoc

During Open Enrollment last year, monthly HSA contribution maximums were calculated based on the IRS limit of $6,900. However, in March the IRS decided to reduce their allowable limit by $50. This may seem like a small change, but exceeding that limit would come with a tax penalty. So, we updated our forms and Solomon pages and set to determining the best process to prevent these overages, while hoping that this decision by the IRS would not stick.

At the end of last month, the IRS reversed this $50 decrease due to the many administrative difficulties that this change would place on employers. The annual family HSA contribution limit of $6,900 has been reinstated for 2018.

This $50 change should only affect those who calculated their family's HSA monthly contributions using the decreased maximum amount of $6,850 and submitted a cafeteria plan form to maximize their contributions based on that new limit. If you think this scenario applies to you and you would like to change your monthly HSA contributions to ensure you maximize the full $6,900 limit, you can do so by submitting an updated Cafeteria Form, which can be found on this page: Cafeteria Plan Enrollment Form - 2018.

Questions?

|

The 2017 tax reform law made major changes that have affected employee withholding for 2018. For the January 12, 2018 paychecks, Reliant used the 2017 withholding tax tables. This withholding was based on guidance from the IRS, due to the fact that the 2018 tax tables were not released in time for our payroll software to have time to update and accommodate for the change. On the February 15, 2018 paychecks, Reliant began using the new 2018 tax tables. Many Reliant employees may have noticed a slight decrease in their federal tax withholding on their February 15, 2018 paychecks due to this change.

On February 28, 2018, the IRS released a 2018 W-4 form. If you would like to submit a Form W-4 (2018 ) to be effective on your April 13, 2018 paycheck, please fill out a new form and email it to payroll@reliant.org using your Reliant email. Forms received by March 30 will be effective for the April 13, 2018 paycheck.

How has the new W-4 form been changed?

The calculations worksheet has been updated to help you calculate your correct withholding allowances based on the new tax reform law.

How do I know what to put on a new W-4 form?

The IRS encourages everyone to use the Withholding Calculator to perform a quick “paycheck checkup.”

The Withholding Calculator helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paychecks.

What information is needed to fill out a Withholding Calculator?

The Withholding Calculator will ask you to estimate values of your 2018 income, the number of children you will claim for the Child Tax Credit and Earned Income Tax Credit, and other items that will affect your 2018 taxes. This process will take a few minutes.

- Gather your most recent pay stubs.

- Have your most recent income-tax return handy; this will help you estimate your tax credits/deductions, such as mortgage interest, charitable contributions, and childcare costs.

- Keep in mind that the calculator’s results will only be as accurate as the information you provide. If your circumstances change during the year, come back to this calculator to make sure that your withholding is still correct.

- The Withholding Calculator does not ask you to provide sensitive, personally-identifiable information like your name, Social Security number, address or bank account numbers. The IRS does not save or record the information you enter on the calculator.

- The Withholding Calculator works for most taxpayers. Taxpayers who owe self-employment tax, alternative minimum tax, the tax on unearned income of dependents or certain other taxes, and people with long-term capital gains or qualified dividends may need to research additional IRS guidelines and resources.

Can Reliant help me with my tax questions?

The Reliant office team cannot advise you on how to fill out a W-4 form or what to put in the Withholding Calculator. Filing your taxes and making sure you have adequate withholding are solely the responsibility of the Reliant employee. If you need assistance, we would encourage you to seek out a tax professional in your area.

This last week participants in Guidestone Medical Insurance received the flyer shown below with information about a benefit available to help participants save on a variety of procedures, and even receive a cash reward.

Vitals SmartShopper helps participants by allowing you to compare the costs of a procedure from multiple providers and offering a cash reward should you choose a more cost-effective option. You can see what rewards are available next to the provider and estimated cost in the search results, when searching online. Or you can call the Personal Assistance Team for assistance in selecting and scheduling a procedure.

See this Solomon page for full details about this benefit: Vitals SmartShopper.

Questions?

|

We have received a few questions regarding the "Record Copy Do Not File" imprint on the digital copies of the 1095-C forms that were emailed by Reliant to our benefits-eligible employees earlier week. We believe these forms have to be printed on special paper if you are filing your taxes by mail — that’s why this e-copy has the statement “Record copy do not file” on it. If you file your taxes by mail, you must enclose the mailed copy you’ll receive with your tax filing to the IRS. If you file electronically, this e-form will be the same as the mailed version you’ll receive in a few days. We recommend keeping the mailed copy in your records when it’s received; however, this e-copy will have the correct info if you’re trying to get a jump on your taxes. Please let us know if you have any other questions regarding the tax forms that you are receiving.

With the new year, comes a new tax season. The Employment Services Team has been working diligently to file the necessary tax documents for each employed missionary. By this time, if you are an employed missionary, you have received an email from payroll@reliant.org to your Reliant email address with information regarding how to access a virtual copy of your W2. If you are unable to access your Reliant email or have not received this notification, please contact us ASAP so that we ensure that you are able to view these important tax documents.

Once you log on, you may see multiple W2's available on the website. If this is the case, please use the highest numbered form. These documents are identical, unless you have received an email from us stating that we needed to update your information.

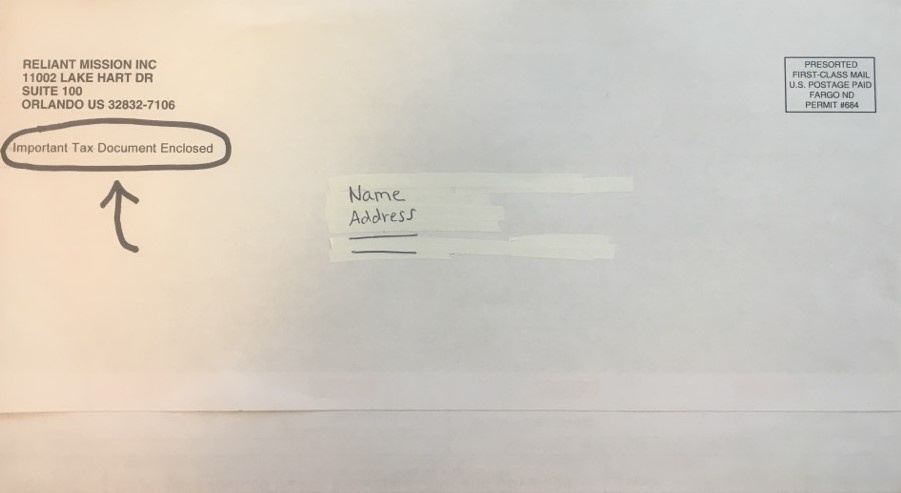

The paper copies of the W2's will be mailed along with the 1095-C forms by the end of January. The envelope will be slightly larger than a standard business envelope and will look like the image below:

Please keep a look out for these documents as you will need them to accurately file your 2017 taxes.

Happy New Year from the Employment Services Team!

As you may be aware, a new tax code was signed into law on December 22, 2017. Some tax experts are calling this the most significant tax code change in 30 years. The IRS is currently working on updating the federal withholding guidelines as stipulated by the new tax code. They have directed us to continue using the 2017 guidelines for calculating federal withholding when processing the January paycheck. We hope that the updated guidelines will be available for processing payroll in February.

You will not be required to submit a new W4, but we understand that you may want to update your exemptions. For this reason, we are extending the deadline for submitted W4's to January 31 for the February paycheck and February 28 for the March paycheck.

Many missionaries may be wondering how their taxes will be affected considering potential raises effective January 1 as well as the new tax code. Reliant will not be able to provide specific answers about tax implications until after the February 15 paycheck has been processed.

Please be aware that Reliant can only assist to educate you on the use of tax forms. We cannot advise you on your individual tax situation. Please contact a tax professional if you would like more information regarding how the tax code changes will impact you.

In the past week, Reliant U.S. missionaries enrolled in Guidestone/Highmark medical benefits for 2018 received new insurance identification cards. It has come to our attention that there was an error in the printing of cards for those on the HS1500 and the HS5000 plans stating that there is a $250 copay for Emergency Room and Inpatient Facilities. The $250 copay only applies to those on the HS3000 plan. Guidestone sincerely apologizes for this error and is working diligently to correct it.

Questions?

|

Eye care is an experience. And EyeMed, our vision benefits provider, makes that experience easy with its member website at eyemed.com. For missionaries who have selected this Cafeteria Plan benefit, Member Web is your vision benefits control center — a place to manage the details of every visit and every claim. Instantly and easily.

When you register on eyemed.com, you can:

- View your vision benefit details

- Confirm eligibility

- Check claim status

- Print replacement ID cards

- Locate a provider — and then schedule an appointment*

- Get special offers

- View health and wellness information

Start managing your benefits in a few easy steps:

- Visit eyemed.com and click on Member Login.

- If you’re a new user, click on Create an Account.

- Register using your member ID or the last four digits of your Social Security number.** (Need help registering? EyeMed provides live chat assistance and user guides.)

- Finish setting up your new account with your email address and password.

Existing users

Starting December 11, EyeMed is upgrading its online security features to further guard your protected health information. Upon your next log in at eyemed.com, you’ll be notified that an email with a verification code has been sent to your email address on file, and you’ll be prompted to enter the code on the site.

Make the most out of your vision benefits by registering and logging into Member Web at eyemed.com today.

*At select in-network providers.

**Depends on how your benefits administrator entered you into the system.

Questions?

|

Many joyous and beautiful things come with the holiday season, but the unexpected can happen too. Just this year, one of our office staff got sick on Thanksgiving and needed a doctor. Because of the offerings available through Highmark, he was able to make a phone call, talk to a doctor, and get the help he needed without leaving home. He was able to do this through Teladoc, a service that Highmark partners with to provide access to doctors, anywhere you have a phone or the internet, 24/7/365. You can see more information about how Teladoc works on this flyer:

Identity theft is yet another unexpected thing that can happen. As we shop more during the holiday season, the risk of identity theft increases. Thankfully, Highmark offers free credit monitoring and identity repair through a partnership with AllClear ID. You are automatically eligible for identity repair as long as you have an active medical plan through Highmark. For credit monitoring, you will need to sign up through the Highmark AllClear ID website. You can see more information about the services and how to sign up on this FAQ page.

Wishing you a Merry (and safe) Christmas!

For those Reliant staff who participate in the Guidestone HSA, we wanted to notify you that the November HSA Contributions were posted on November 17th. The funds were available as scheduled, but there was a slight delay in the deposits appearing on the Highmark website. We apologize for any inconvenience this delay may have caused.

As we have been using our own HSA's with the new custodian, we have noticed that there are two things to note.

First, there are new Terms of Service for the website that can be accepted, as seen below. These Terms of Service do not impact the the ability of the HSA to be utilized.

There also was a delay in transferring the spending history. If you were having problems accessing your spending history, here are a few steps that you can take to access that history.

- Claims Tab -- any claim paid via the Claims tab will continue to display HSA processing information (i.e. Paid by HSA, Pay Claim)

- Spending Tab -- members can click link Get details, cash statements, tax forms & deposit slips. From here, transaction history can be viewed under the Claims header, Claims Activity drop down.

- Spending Tab -- members can click link Get details, cash statements, tax forms & deposit slips. From here, members can find link to Statements and Tax Form to locate historical HSA cash statements.

We hope that this clears up any issues you may have had with the new HSA Accounts. Please let us know if you have any other questions!

Email: benefits@reliant.org Phone: 407-630-5904 Title: Benefits Coordinator Department: Employment Services Jennifer Greening

As of today , Health Savings Accounts for those participating in Reliant's Domestic Health Saver medical plans are now active with the new custodian bank, Acclaris, Inc. Last week, you should have received a welcome packet as well as a new debit card. Debit cards can now be activated and used for eligible medical expenses.

If you paid out of pocket for any eligible medical expenses while HSA's were inactive, you can submit to Highmark for a reimbursement from your HSA. Directions for this process can be found on the Solomon page, Filing a Reimbursement from your HSA.

Thank you for your patience in this transition!

Hello, Reliant Missionary! It's Open Enrollment time!

Open Enrollment is the time when you have the opportunity to...

- Change plan level choices

- Update your family status and information

- Activate Payroll Deduction Cafeteria Plan choices (Health Savings deposits, Vision Insurance, Child-Care benefit)

Changes submitted during Open Enrollment become effective January 1, 2018. Please read the Open Enrollment Memo for full details of rates, changes, etc.

Who needs to participate in Open Enrollment this year?

Most of us do. Here is a list of specifics. If you...

- Participated in the HC 2000 Plan in 2017, you will now need to choose an HSA Plan from GuideStone because this HC Plan option is being phased out at the end of 2017.

- Wish or need to Change an Insurance Plan; each year you may change your insurance plan level option.

- Contribute to your HSA (Health Savings Account) from your paycheck. This must be renewed annually.

- Elect Child-Care benefit or Vision Insurance. These must be renewed annually.

- Had a change in your family this year (births, adoptions, marriage, fewer or more dependents). This is a great time to update all your personal information and insurance selections.

- Waived Reliant's insurance. Your waiver must be renewed and approved annually.

This year's changes will again be submitted on a single electronic form.

International Open Enrollment

Internationals will have Open Enrollment October 18 to November 10. You will receive information next week.

Waivers

All missionaries who have waived Reliant's Medical Insurance in the past must submit new waiver forms with proof of insurance by November 5, 2017. You may also utilize the Open Enrollment period to choose a Reliant medical plan for 2018 if you would like.

Read Full Details of Rates and Changes in the 2018 Enrollment Memo

This week, participants in Highmark's HSA received notification of a change coming regarding HSA accounts. As of November 6, Bank of America will no longer be custodian of the HSA accounts. Beginning November 15, Acclaris Inc. will be the new custodian.

Between those two dates (Nov 6-14), the HSA accounts will be moved from Bank of America to Acclaris and will not be accessible.

While there will be very few long-term impacts of this change, there are a few actions that missionaries with an HSA will need to take in order to make this transition as easy as possible.

Please refer to the Solomon page below for information regarding the transition including important dates, how to prepare for the transition period, and the actions needed to utilize the new account.

Announcement - HSA Accounts Being Transferred from Bank of America to Acclaris - November 2017

Questions?

Email: benefits@reliant.org Phone: 407-630-5904 Title: Benefits Coordinator Department: Employment Services Jennifer Greening

Student loan debt is a savings barrier for many college graduates. It can be difficult (and stressful) to decide between paying down debt and saving for retirement. This article is an excellent resource for understanding different types of debt and tips to prioritize debt payment and saving.

Should You Pay Off Student Loans Before Saving for Retirement? by Carrie Schwab-Pomerantz