For assistance, problems or questions, please email us.

Page History

"Option 1: Estimated Taxes

The minister pays federal income taxes and social security taxes (SECA) directly to the IRS. form 1040-ES is filed by the minister on 4/15, 6/17, 9/16, and 1/15."

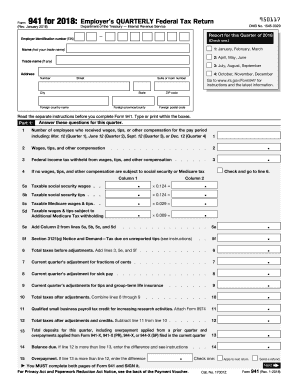

"Option 2: Voluntary Withholding

The church withholds federal income tax and pays quarterly to the IRS. Additional federal income tax may be withheld to cover the minister's social security tax (SECA) liability. Forms 941 filed with the IRS quarterly by the church. The W-2 is provided to the minister and the IRS."

(“Chapter 7 - Paying Taxes.” Zondervan 2019 Minister's Tax & Financial Guide for 2018 Tax Returns, by Daniel D. Busby et al., Zondervan, 2019, p. 114.)